Mastering Time Management for Career Success

Time, the most precious and finite resource, often slips through our fingers. In this fast-paced world, mastering the art of time management is not just a skill but a necessity. As we delve into the intricacies of time management, we begin to unearth its profound impact on career success and life satisfaction.

Understanding Time Management

Time management isn’t merely about allocating hours; it’s about allocating hours wisely. It involves the reasonable allocation and organisation of your time to accomplish specific personal and professional tasks. Essentially, it’s not about doing more; it’s about doing more of what truly matters.

The link between time management and career success is undeniable. By effectively managing your time, you don’t just complete tasks; you complete them efficiently, meeting deadlines and reducing stress. This combination enhances your overall performance and opens doors to new opportunities in the professional realm.

Essential Time Management Skills

Prioritisation is a foundational skill in time management. It’s about distinguishing between tasks based on their importance and urgency, allowing you to allocate your time and efforts judiciously. Effective prioritisation ensures that the most vital tasks are tackled first.

A clear vision of your career goals is pivotal in the realm of time management. These goals serve as your compass, guiding you in allocating your time effectively. With well-defined goals, you can create a roadmap to success, helping you make the most of your time.

Organising your tasks, whether through categorisation, scheduling, or utilising various time management tools, ensures you are in control of your commitments. With a well-organised plan, you can avoid the chaos and stress that comes with a disorganised workload.

The Impact of Time Management on Career Goals

The correlation between time management and career goals is significant. When you manage your time effectively, you work smarter, not harder. This increases your productivity, impresses your colleagues and superiors, and results in steady progress toward your career objectives.

Countless individuals have achieved their career goals by mastering time management. Take, for instance, successful entrepreneurs who credit their achievements to disciplined time management. Learning from their experiences can inspire and motivate you on your own journey.

Practical Time Management Techniques

The Pomodoro Technique is a tried-and-true method for enhancing productivity. It involves breaking your work into focused, time-bound intervals (usually 25 minutes), followed by short breaks. This technique not only boosts productivity but also maintains your enthusiasm throughout tasks.

Creating to-do lists is a classic yet effective way to visualise your tasks and stay organised. By listing your tasks and prioritising them, you ensure that you tackle the most important ones first, creating a sense of accomplishment.

Identifying and eliminating common distractions in your work environment is crucial for time management. Simple steps like turning off notifications, setting specific work hours, and finding a quiet space can make a world of difference.

Overcoming Common Challenges

Procrastination can be one of the most formidable adversaries to effective time management. It’s essential to identify the root causes of your procrastination and develop strategies to combat it, such as setting clear deadlines and breaking tasks into smaller, manageable steps.

Multitasking, often viewed as a badge of productivity, can lead to subpar results. By focusing on one task at a time, you ensure the quality of your work and improve your time management skills.

Balancing Work and Life

Time management is not solely about your career but your overall well-being. Maintaining a healthy work-life balance prevents burnout and ensures long-term career success. It’s about living, not just working.

Measuring and Refining Your Time Management Progress

Setting benchmarks and tracking progress is vital for improving your time management skills. Regularly evaluating your routines and identifying areas where you can optimise your time use is the path to continuous self-improvement.

In a world where time is fleeting, and careers are demanding, mastering time management is the blueprint for career success. You can work efficiently and reduce stress by prioritising tasks, setting goals, and applying practical techniques. Remember, success in your professional life is within your reach, and it starts with how you manage your time effectively.

Connect with our Career and Life Coaching experts with just a few taps on oLife via the oDoc app!

Sources

- Dierdorff, Erich C. “Time Management Is About More Than Life Hacks.” Harvard Business Review, 29 January 2020, https://hbr.org/2020/01/time-management-is-about-more-than-life-hacks.

- Why Is Time Management Important to Success? | Motion.” Motion, 16 May 2023, https://www.usemotion.com/blog/why-is-time-management-important.

- Brill, Omri. “Mastering Time Management Skills: The Essential Guide.” Adcore, 18 July 2023, https://www.adcore.com/blog/mastering-time-management-skills-the-essential-guide/

Similar Articles...

Let’s talk flu, its prevention and home remedies.

Boo-ger season is here! Let’s begin by defining flu (short term for influenza) because it’s usually misunderstood as fever or cold. Flu is a common

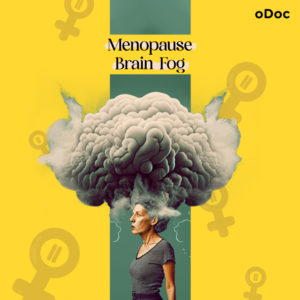

Menopause Brain Fog is real: A Simple Guide with Symptoms and Treatment

Menopause Brain Fog is real: A Simple Guide with Symptoms and Treatment Women in their 40s and 50s who are just entering the end of

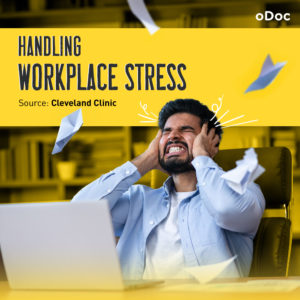

How to Keep Work Stress from Taking Over Your Life

How to Keep Work Stress from Taking Over Your Life In today’s fast-paced and competitive world, work stress has become an all-too-common problem that affects